Streamlining Insurance with the Bloom Customer Portal

A One-Stop Solution for Insurance Customers

In today’s fast-paced world, convenience is key—especially in the insurance industry. Customers no longer want to navigate lengthy paperwork or wait in queues to manage their insurance needs. Instead, they seek seamless, digital solutions that simplify their interactions. Enter the Bloom Customer Portal by Redian Software, a game-changing platform tailored for insurance companies and aggregators.

The Bloom Customer Portal empowers insurance providers with a comprehensive mobile app and web portal, offering a wide range of self-service features designed to enhance customer satisfaction and operational efficiency.

Gone are the days when buying insurance was a tedious, time-consuming process. The Bloom Customer Portal provides a seamless experience through its Mobile App, Web Portal, and USSD integration. Whether a customer is on their smartphone, browsing on their desktop, or using basic feature phones, they can access insurance services anytime, anywhere.

Key Features of the Bloom Customer Portal

1. Comprehensive API Framework

The platform’s robust API-based framework enables smooth integration with third-party systems. This means insurance companies can effortlessly connect the portal with:

- Core insurance systems for policy management and claims processing.

- Revenue authorities for tax compliance and verifications.

- Payment gateways for secure, multi-channel transactions.

- Transport authorities for vehicle insurance validations.

- and many more

2. Digital KYC

Compliance and customer onboarding are simplified with the portal’s Digital KYC capabilities. Customers can quickly verify their identity using government-approved documents, reducing onboarding time from days to minutes.

3. End-to-End Customization

The portal is designed to adapt to the unique needs of different insurance providers. From branding to feature sets, companies can customize the platform to align with their business goals and customer expectations.

4. USSD Integration

For regions where internet penetration is low, the portal’s USSD-based services ensure inclusivity. This feature allows customers to access insurance services through simple codes on their feature phones, democratizing access to financial security.

System Highlights

The Bloom Customer Portal goes beyond just policy purchases. It offers an end-to-end solution that allows customers to:

1. Buy Insurance Policies

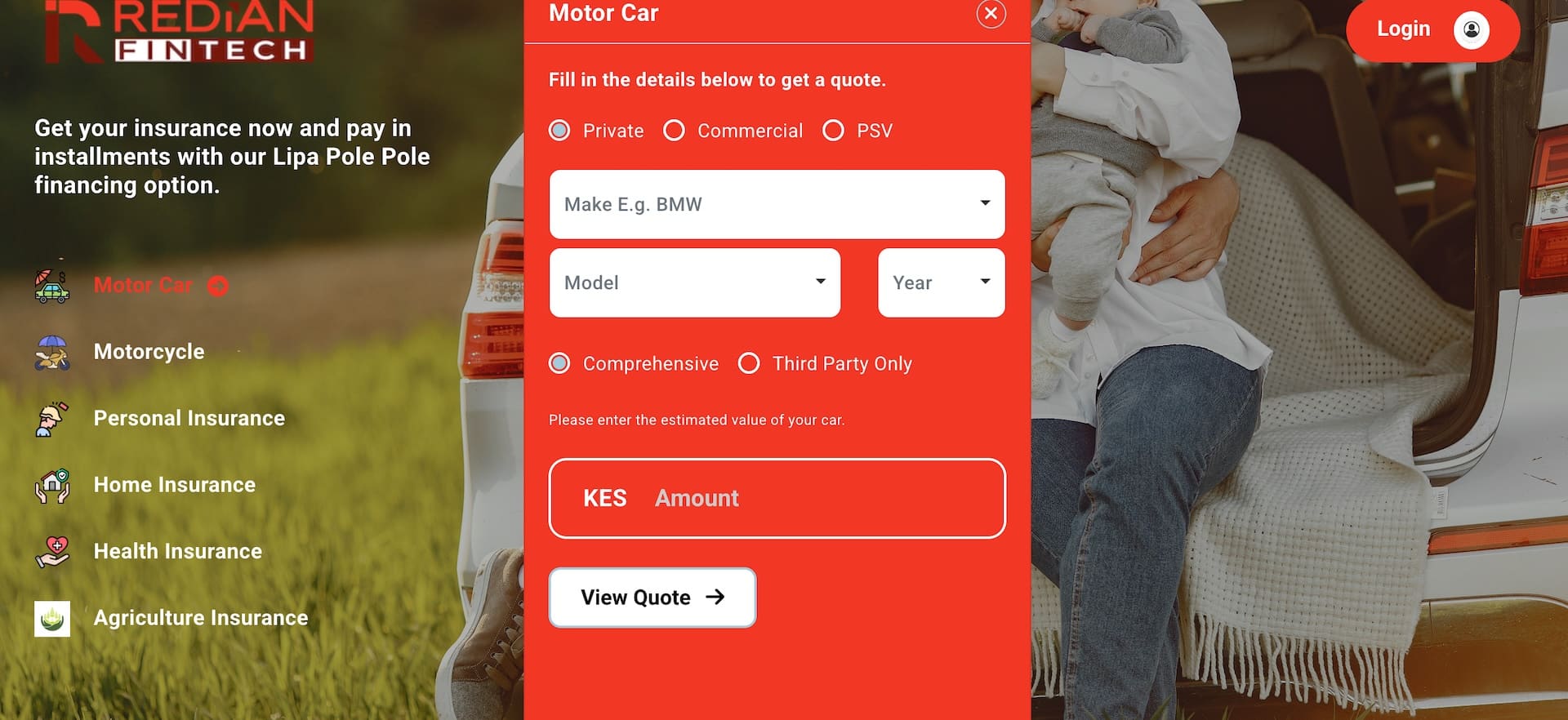

With a user-friendly interface, customers can browse, compare, and purchase insurance products effortlessly. The streamlined journey ensures that buying insurance is as simple as shopping online.

2. Endorse Policies

Life changes, and so do insurance needs. Bloom’s portal allows customers to make endorsements, such as updating personal details or modifying coverage, directly through the app or portal.

3. Renew Policies Instantly

Renewing insurance policies is no longer a hassle. Bloom sends proactive reminders for renewals and offers an easy-to-use process to ensure continuous coverage.

4. Submit and Track Claims

Filing claims can be one of the most stressful parts of the insurance experience. With the Bloom Customer Portal, customers can submit claims digitally, upload required documents, and track their claim status in real time—all from the comfort of their homes.

5. Access Real-Time Customer Support

Whether it’s a quick question or in-depth assistance, customers can connect with support teams through integrated chat, email, or call options. The portal ensures timely and effective communication.

How Bloom Benefits Insurance Companies

The Bloom Customer Portal isn’t just about customer convenience—it’s also a powerful tool for insurers to streamline operations and drive growth.

1. Increased Customer Engagement

By offering a tailored, digital-first experience, insurance providers can engage customers more effectively, building trust and loyalty over time.

2. Reduced Operational Costs

Automating processes like endorsements, renewals, and claims reduces manual intervention, saving time and money while minimizing errors.

3. Improved Claim Processing

With digital submission and tracking, insurers can expedite claim settlements, improving customer satisfaction and brand reputation.

4. Real-Time Analytics

The portal provides valuable insights into customer behavior, enabling insurers to refine products, pricing, and strategies for maximum impact.

The Bloom Advantage

Bloom isn’t just another portal; it’s a tailored solution designed with both customers and insurers in mind. Its modular architecture allows companies to:

- Integrate third-party systems such as core insurance platforms, payment gateways, and regulatory bodies.

- Adapt branding and features to align with specific business needs.

- Reach all customer demographics, thanks to its mobile app, web portal, and USSD support for underserved regions.

Why Choose Redian Software?

At Redian Software, we understand the unique challenges of the insurance industry. That’s why the Bloom Customer Portal is more than just a product—it’s a commitment to innovation, efficiency, and customer-centricity.

With the Bloom Customer Portal, insurance companies can transform their operations, deliver superior customer experiences, and stay ahead in an increasingly competitive market.

Ready to Revolutionize Your Insurance Business?

Empower your customers and streamline your operations with the Bloom Customer Portal. Contact Redian Software today for a personalized demo and see how Bloom can help you unlock your full potential.

The future of insurance is here—let’s build it together.