Kenya’s SACCO sector is dynamic and growing, driven by a mission to empower members financially. But in today’s digital world, staying competitive means embracing technology that meets members’ evolving needs. This is where a mobile banking software company for SACCOs becomes a crucial partner.

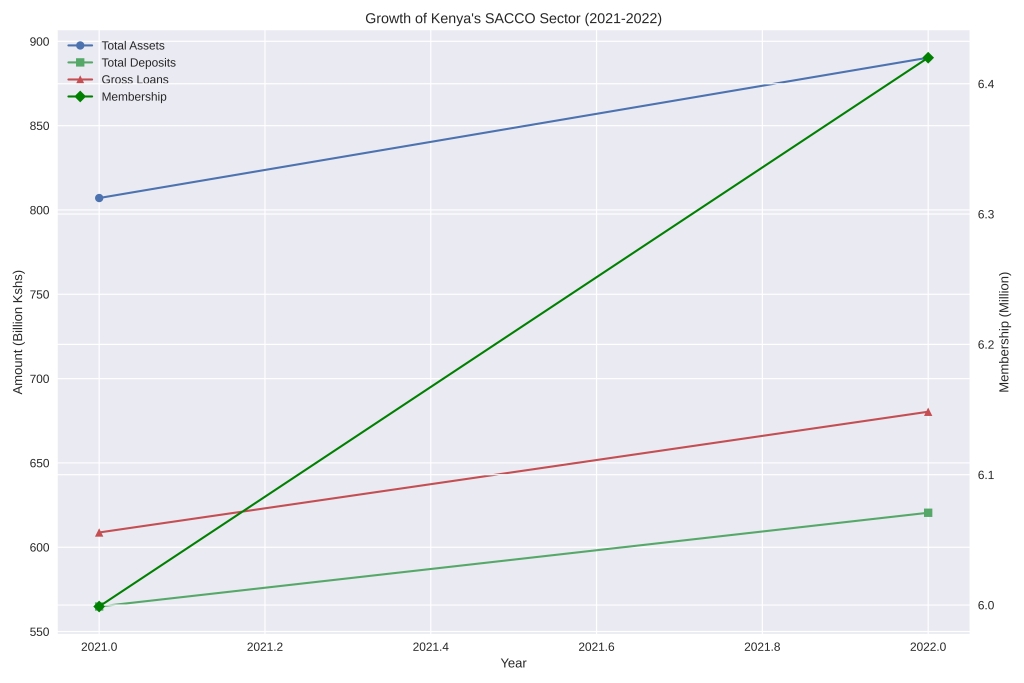

Source: Sacco Societies Regulatory Authority (SASRA)

This chart demonstrates the growth of Kenya’s SACCO sector from 2021 to 2022. The chart shows the consistent growth in key performance indicators: total assets, total deposits, gross loans, and membership.

Why Mobile Banking is Essential for SACCOs

Traditional banking methods simply can’t keep up with today’s tech-savvy members. They expect instant access to their finances, convenient transactions, and personalized experiences. Mobile banking software delivers on these demands, offering:

24/7 Account Access

Members can check balances, transfer funds, pay bills, and apply for loans anytime, anywhere.

Increased Convenience

Say goodbye to long queues and limited banking hours. Mobile banking puts the power of finance in members’ hands.

Member Engagement

Personalized notifications, in-app messaging, and targeted offers keep members informed and engaged.

Reduced Costs

Mobile transactions are often more cost-effective for SACCOs than traditional branch-based services.

Challenges Facing SACCOs in Kenya

-

CompetitionThe rise of fintech companies and digital banks is putting pressure on SACCOs to modernize their offerings.

-

Security ConcernsProtecting member data and ensuring secure transactions is paramount in the digital world.

-

Finding the Right Technology PartnerSelecting a mobile banking software company for SACCOs with the right expertise and experience is crucial.

Choosing the Best Mobile Banking Software Company for SACCOs

Here’s what to look for when evaluating a mobile banking software provider:

Proven Track Record

Choose a company with experience developing and implementing mobile banking solutions specifically for SACCOs in Kenya. Look for case studies and client testimonials.

Security & Compliance

Ensure the software meets the highest security standards and complies with relevant regulations to protect member data.

User-Friendly Interface

The mobile app should be intuitive and easy for members of all technological backgrounds to use.

Customization & Integration

The software should be customizable to fit your SACCO’s unique needs and integrate seamlessly with your existing core banking system.

Feature-Rich Functionality

Look for features that meet your members’ demands, such as loan applications, bill payments, account management, and personalized financial tools.

Ongoing Support & Maintenance

Choose a provider that offers reliable technical support and regular software updates to ensure a smooth and secure mobile banking experience.

Redian Software Your Partner in Mobile Banking Success

At Redian Software, we specialize in crafting innovative mobile banking solutions that empower SACCOs to thrive in the digital age. Our team of expert developers and consultants understands the unique needs of the Kenyan market and is dedicated to delivering tailored solutions that drive member satisfaction and business growth.

We offer:

- Custom Mobile Banking App Development: We build secure, user-friendly, and feature-rich mobile banking apps tailored to your SACCO’s requirements.

- Core Banking System Integration: Our solutions integrate seamlessly with leading core banking systems, ensuring smooth data flow and efficient operations.

- Ongoing Support & Maintenance: We provide reliable technical support and regular software updates to keep your mobile banking platform secure and up-to-date.