The days of brick-and-mortar banking are fading fast. Today’s customers want to manage their finances anytime, anywhere, with a few taps on their smartphones. This shift towards digital banking is creating a huge demand for innovative banking software development companies in Asia.

Digital Banking Market Analysis

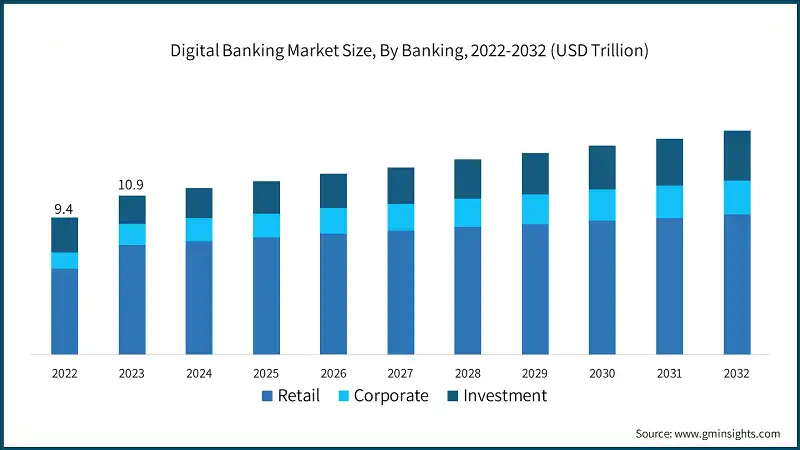

The banking market is divided into three main categories: retail, corporate, and investment. Retail banking, the largest segment, offers services like savings accounts, personal loans, and credit cards tailored for individual consumers. This segment is essential due to its focus on accessibility, convenience, and personalized customer experiences, generating significant revenue from transaction fees, interest income, and service charges.

A notable example of its growth is in India, where retail digital payments increased from 162 crore transactions in FY13 to over 14,726 crore by FY24. The LTE segment in banking is expected to surpass USD 9 trillion by 2032.

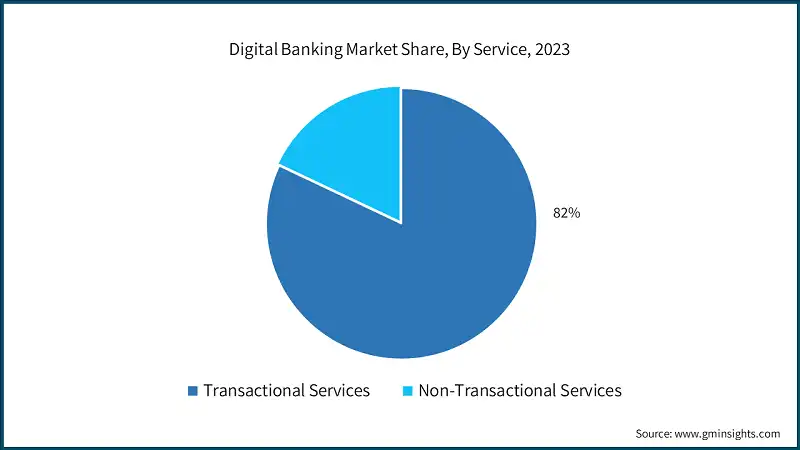

The digital banking market is segmented into transactional and non-transactional services, with transactional services holding around 82% of the market share in 2023.

Transactional services are crucial for immediate financial needs, such as cash deposits and withdrawals, fund transfers, and automated services like auto-debit and auto-credit, which streamline recurring payments.

Additionally, digital loan processes simplify applications and expedite approvals, making credit more accessible. These features collectively enhance efficiency and convenience, driving the adoption of digital banking.

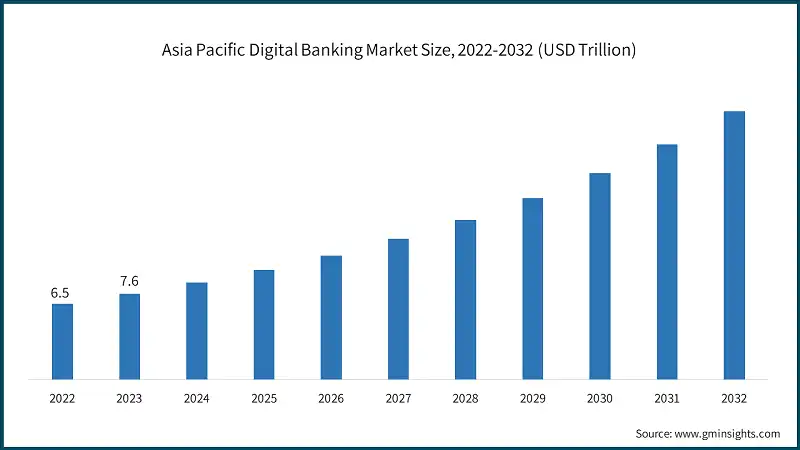

In 2023, Asia Pacific led the digital banking market with over 69% share, driven by a large population and extensive internet connectivity. Key countries include China, India, and Indonesia.

In China, mobile payment platforms like Alipay and WeChat Pay are widely used for daily transactions. India sees high usage of digital payment systems such as Paytm and Google Pay for peer-to-peer transfers and online purchases.

Similarly, Indonesia’s mobile banking apps like GoPay and OVO are popular, highlighting the region’s significant digital banking adoption.

To stay ahead in this evolving landscape, financial institutions need a strong technological foundation built on innovative and reliable software solutions. This is where choosing the right banking software development company becomes a critical decision.

The Rise of Digital Banking

-

Mobile-First BankingMobile banking apps are now the primary touchpoint for many customers, requiring seamless user experiences and advanced features.

-

Internet BankingSecure and feature-rich online banking platforms are essential for managing accounts, payments, and other financial services.

-

Fintech IntegrationBanks are increasingly partnering with fintech companies to offer innovative solutions like digital lending, payments, and wealth management.

Why a Specialized Banking Software Development Company Matters

Off-the-shelf software solutions often fall short of meeting the unique and complex needs of banks and financial institutions. A specialized banking software development company in India can provide tailored solutions that address specific challenges and unlock growth opportunities.

Here's why this expertise is crucial

A dedicated banking software development company understands the intricacies of the financial sector, including regulatory compliance, security standards, and evolving customer expectations.

They can develop bespoke software solutions that align perfectly with your bank's specific workflows, processes, and business goals, whether it's a core banking system, internet banking platform, mobile banking app, or a custom solution for a specific department.

They can integrate new software solutions with your existing core banking systems and legacy applications, ensuring a smooth transition and data consistency.

They leverage agile methodologies to deliver solutions quickly, adapt to changing requirements, and ensure ongoing improvement.

Trends Shaping the Banking Software Landscape in India

-

Mobile BankingCustomers are increasingly reliant on mobile devices for their banking needs, demanding user-friendly and feature-rich mobile banking apps.

-

Open Banking and APIsOpen banking initiatives are driving the need for secure and standardized APIs to enable data sharing and integration with third-party financial services.

-

AI and AutomationArtificial intelligence and automation are transforming banking operations, from customer service chatbots to fraud detection and risk management.

-

Cloud-Based SolutionsCloud adoption is accelerating in the banking sector, offering benefits like scalability, cost-effectiveness, and enhanced security.

What to look for in a banking software development company

Redian Software Your Trusted Banking Technology Partner

Redian Software is a leading banking software development company in India, renowned for delivering innovative and reliable solutions that empower financial institutions to thrive in the digital age. We have a proven track record of success, a team of highly skilled developers, and a deep understanding of the Indian banking landscape.

Our Comprehensive Banking Software Solutions

Why Choose Us?

We understand the intricacies of the Indian banking sector and the challenges faced by financial institutions.

Our skilled developers have extensive experience in building secure, scalable, and high-performing banking software solutions.

We prioritize collaboration, communication, and client satisfaction, ensuring your project is a success.

We leverage the latest technologies and development best practices to deliver high-quality, innovative solutions.

Contact us today to discuss your banking software needs and let us help you build a competitive edge in the evolving digital landscape.